theScore Goes LIVE Today – Sets IPO Price, Increases Initial Share Offering

TheScore Media and Gaming announced its U.S. initial public offering on Monday and goes live today, as the Canadian sports media company will be traded on the NASDAQ. The board of directors and shareholders voted in favor of a dual listing in the U.S. and Canada.

@theScore starts trading today under $SCR

Let the good times begin #Gambling #sports @stoolpresidente pic.twitter.com/6hlp3PyF7U— Capital Gains (@InvestedGains) February 25, 2021

The price was set on Wednesday for its initial public offering (IPO) in US markets on Nasdaq (SCR) at a price of $27 per share and will go live today.

TheScore planned to sell five million Class A shares and be traded under the symbol “SCR.” but quickly adjusted that number to six million. Morgan Stanley, Credit Suisse, Canaccord Genuity, and Macquarie Capital are underwriters for the IPO deal.

Score Media and Gaming is part of the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ). What is an ETF?

According to Investopedia, An exchange-traded fund (ETF) is a type of security that involves a collection of securities—such as stocks—that often tracks an underlying index, although they can invest in any number of industry sectors or use various strategies. ETFs are in many ways similar to mutual funds; however, they are listed on exchanges, and ETF shares trade throughout the day just like an ordinary stock.

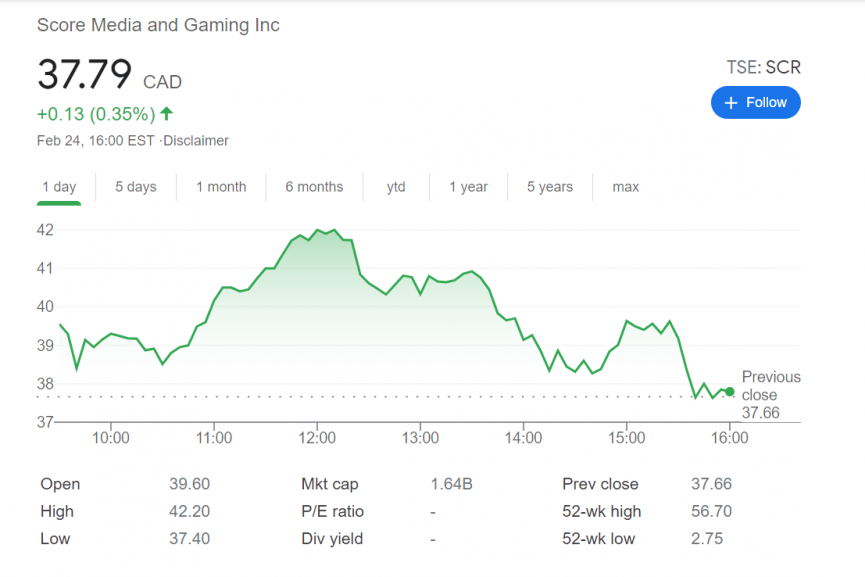

TheScore closed at C$37.79 CAD on Wednesday, and the stock price is up 162% since the start of 2021.

Positive Vibes Only for theScore

TheScore continues with its recent streak of good fortune over the last month. The Canadian sports media giant has been making moves to get an IPO listing in the U.S. and finally do so on Monday.

Last week, theScore announced it would be launching its mobile betting app, theScore Bet, in Iowa, making it the fourth state theScore Bet operates in. The company plans on launching in 11 U.S. states thanks to a multi-state partnership with Penn National Gaming.

On top of U.S. expansion, theScore Bet has the potential to be the Canadian sports betting leader if its home country legalizes single-game wagering. Last week, the Canadian sports betting bill, C-218, passed through its second reading in the House of Commons 303-15 – making it one step closer to legalization.

TheScore is headquartered in Toronto, Ontario, home to roughly 14.5 million people and about 1.4 million daily active users in the Province alone. The potential theScore is seeing right now is limitless.

What Does the Future Hold for theScore?

As of writing, theScore has operations in Colorado, Indiana, Iowa, and New Jersey with its partnership with Penn National. Now that theScore received an IPO offering in the U.S., it will only help the company grow more and can use the money from invested shares to continue growing in the U.S.

Canada also has a legitimate shot at approving single-game wagering and expanding its sports betting market. TheScore estimates that Canada could see $5.4 billion in annual revenue if the industry is expanded.

Getting in on the ground floor of theScore’s IPO might be the best option for investors. TheScore can be traded for about $30 a share now and will start off at $27 when it’s traded on the NASDAQ. Between the potential of expanding to at least 11 states in the U.S. and being the first to capitalize on the Canadian sports betting market, there is a lot to like about theScore as a publicly-traded company.